Construction growth in Singapore sees a 12% rise in productivity in 2024, outstripping the country’s overall GDP growth rate of 2-3% four times over, according to Turner & Townsend.

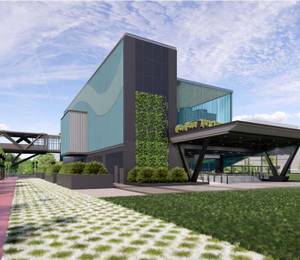

With construction volume anticipated to reach S$32-38 billion by the end of 2024, Turner & Townsend’s Singapore Market Intelligence cites a series of government backed initiatives and major state projects, such as Changi Airport Terminal 5 (T5) and Tuas Port, are key contributors boosting demand.

Recent built environment incentives including the enhanced Contractors Registration System (CRS), Productivity Innovation Project (PIP), Future Energy Fund and Energy Efficient Grant (EEG) are supporting activity. By year-end, the Singapore government is expected to contribute to 55% of domestic construction projects while the private sector is poised for a contribution of 45%.

Despite ongoing global economic uncertainty and geopolitical instability, the construction market in Singapore is also benefitting from investment in digital infrastructure and the launch of the NEC4 contract by the Building Construction Authority (BCA). The latter provides favourable conditions and extensive options for collaborative contracting.

While the overall growth trajectory is positive for the domestic construction sector, there are still challenges to navigate principally the availability of skilled labour. The departure of many construction workers during the pandemic continues to highlight the labour squeeze and increasing costs to secure the right talent.

“Construction demand in Singapore is on course to surpass last year by a significant margin, which is positive for our domestic economy,” said Khoo Sze Boon, managing director at Turner & Townsend in Singapore. “The industry’s overall positive outlook stems from the series of ongoing government initiatives connected to the built environment including robust schemes to promote funding, foster technological advancements, ensure ease of doing business, and boost sustainable green initiatives.

“While challenges persist, such as manpower shortages and rising costs, optimism around collaborative contracting schemes and the digitisation of processes will further improve productivity. We believe now is the time for our industry to really embrace collaborative contracting, which will offset rising construction costs and transform the construction sector for the better to ensure long-term resilience.”

The full report on Singapore can be viewed here.

Stable growth for Hong Kong

Earlier in June, Turner & Townsend revealed that Hong Kong’s construction industry is set for stable growth in 2024 as the economy continues to recover in the aftermath of Covid-19.

The company’s report highlights a robust pipeline of key public and private sector projects focusing on housing, public infrastructure, and investments into technology, such as the anticipated railway projects designed to enhance connectivity and transport options for travel and freight within the Greater Bay Area (GBA).

Hong Kong’s GDP is forecast to grow between 2.5% and 3.5% in 2024, following a 3.2% increase in 2023. Due to an expected dip in private sector construction activity and spending on public projects this year, Hong Kong’s construction industry tender prices are predicted to rise by 2% in 2024, compared to 4% in 2023, 3% in 2022, and 5% percent in 2021.

A stronger Hong Kong dollar and reduced demand for materials from mainland China are expected to lower material costs this year. The price of galvanised mild steel plates dropped by 18.3% from December 2022 to December 2023, while sand decreased by 4.1%, and aggregates by 8.3%. High tensile steel bars saw a 7.3% decrease, while Portland cement had a slight increase of 0.9%, and sawn hardwood costs remained unchanged.

Fluctuating material costs continue to pose a challenge for Hong Kong’s construction industry this year as the existing shortage of skilled workers, rising labour costs and high construction costs continue to hamper growth.

The Hong Kong government is committed to land and housing developments, with a target to provide 440,000 housing units by 2033-34, with a 70:30 split between public and private housing.

The report acknowledges the government’s positive 2024-25 budget policy, demonstrating a commitment to long-term investment in the construction industry. Capital works expenditure is projected to reach up to HK$90 billion, focusing on enhancing infrastructure connectivity within the GBA through projects like the ‘GBA on the Rail’ initiative.

Technology remains a prime focus, with investments in the Hong Kong Microelectronics Research and Development Institute (HKMSRDI) and the Cyberport 5 project. The establishment of a steering committee by the Development Bureau (DEVB) to enhance the use of modular integrated construction (MiC) and evaluation of investment in the MiC supply chain is also expected to boost innovation and productivity in the construction industry.

These initiatives, alongside recommendations from the Digital Economy Development Committee (DEDC) aim to fast-track growth in the IT sector, adding 79,000 sq m of gross floor area to existing technology infrastructure.

“The focus on the construction industry as a key pillar of Hong Kong’s growth continues, underscored by ongoing government commitment. The Budget focused on infrastructure spending reaffirms the government’s growth ambitions,” explained Daniel Cheung, director, strategic lead, Hong Kong and Macau, at Turner & Townsend. “With key projects reprioritised and newer funding models being deployed, especially with the Northern Metropolis project and transport infrastructure expansion, the government’s ability to enable higher efficiency and cost-consciousness in project delivery becomes imperative.

“Overall, the construction market has moved towards a steady, yet cautious growth outlook given current macro-economic factors. As Hong Kong’s construction projects become larger and more complex, financial prudence and effective programme management becomes increasingly important in assessing and executing the most appropriate project delivery model to achieve planned project outcomes on time, secure procurement savings, and deliver lasting value to businesses and Hong Kong’s fast-evolving built environment.”

The full report on Hong Kong can be viewed here.

Image 1: Timo Volz/Pixabay

Image 2: Michael Siebert/Pixabay