The total construction demand (value of construction contracts to be awarded) in Singapore is projected to remain strong in 2020, ranging between S$28 billion and S$33 billion, according to the Building and Construction Authority (BCA). This is due to sustained public sector construction demand, which is expected to reach between S$17.5 billion and S$20.5 billion this year, accounting for approximately 62% of the demand.

The public sector construction demand would include major infrastructure projects - which are larger and more complex in scale - such as the Integrated Waste Management Facility, infrastructure works for Changi Airport Terminal 5, Jurong Region MRT Line and Cross Island MRT Line.

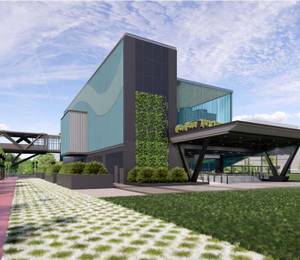

The private sector construction demand is anticipated to reach between S$10.5 billion and S$12.5 billion this year, supported by projects such as redevelopment of en-bloc sale sites, recreational developments at Mandai Park, Changi Airport new taxiway and berth facilities at Jurong Port and Tanjong Pagar Terminal. BCA pointed out that the forecast for 2020 excludes any construction contracts by the two Integrated Resorts (IRs), pending confirmation on the timeline and the phasing of the expansion projects.

Last year, Singapore’s total construction demand expanded by 9.5% to reach S$33.4 billion, about S$1.4 billion higher than the upper bound of BCA’s 2019 forecast of S$27 billion to S$32 billion. This was mainly due to a stronger than expected increase in industrial construction demand for petrochemical facilities despite the slowdown in manufacturing sector.

Outlook for 2021 to 2024

Construction demand in Singapore is expected to hold steady over the medium term, said BCA. Demand is projected to reach between S$27 billion and S$34 billion per year for 2021 and 2022, and between S$28 billion and S$35 billion per year for 2023 and 2024.

The public sector will continue to lead demand and is expected to contribute S$16 billion to S$20 billion per year from 2021 to 2024, with building projects and civil engineering works each taking up about half of the demand. Besides public residential developments, public sector construction demand over the medium term will continue to be supported by various mega infrastructure projects.

The private sector construction demand is expected to stay at a moderate level in view of the likely continued global economic uncertainties and the current overhang in the supply of private residential housing units. Nonetheless, the planned expansion of the two Integrated Resorts could provide further upside to private sector demand, depending on their eventual construction timelines and phasing.

Furthermore, Singapore’s total nominal construction output in 2020 is projected to increase to between S$30 billion and S$32 billion, from the estimated S$28 billion in 2019. The anticipated further pick-up in total construction output in 2020 is supported by the improved construction demand since 2018 following the slowdown in 2015 to 2017.

Industry transformation through DfMA and IDD

Singapore’s Minister of State for National Development and Manpower, Zaqy Mohamad, also urged the industry to continue to invest in a skilled and competent workforce with a strong local core, in order to sustain business growth and the good progress in transformation that have already been made.

Since the Construction Industry Transformation Map was launched in 2017, the local industry has been using newer and more advanced technologies to improve construction processes and methods and ultimately creating new and better jobs for those working in the sector. For example, more projects are adopting the Design for Manufacturing and Assembly (DfMA) method, where a substantial portion of work is now done in a controlled manufacturing environment before it is transported to site for assembly.

BCA revealed that the DfMA adoption rate by the local industry shows an improvement from 22% in 2018 to about 30% in 2019, setting a good progress towards the target of 40% by 2020. The public sector, like HDB, will continue to take the lead in adopting DfMA in their building projects where 75% of all its units launched in 2020 will adopt DfMA methods, including prefabricated prefinished volumetric construction (PPVC) or advanced precast concrete system (APCS).

Besides DfMA, Integrated Digital Delivery (IDD) has been identified as another key transformation area for the built environment sector in Singapore. Those who implement IDD can expect to reap benefits such as productivity gains throughout the building life cycle, reduction of costs and waste by minimising reworks and improving site safety. For instance, BHCC Construction aims to achieve 30% time savings during the design of a project by using Virtual Reality (VR) collaboration system and 25% time savings by digitalising its management of site safety records.

Similarly, the multi-disciplinary project team including the builder behind the Tuas Port Maintenance Base aims to achieve 20% time savings by using a cloud-based digital platform for managing defects and site safety during construction works. The team also expects to achieve a 20% productivity improvement in maintenance work by integrating data from the Building Information Modelling (BIM) into their building management system when the building is completed.

These transformation efforts have reportedly led to the redesign or creation of new and better jobs, such as digital lead and DfMA production manager within the sector. To support the sector’s transformation growth, BCA is also working with industry partners on initiatives to attract more fresh graduates and mid-careers into the sector, as well as a skills framework to chart out career progression pathways, which is scheduled to be launched later this year.